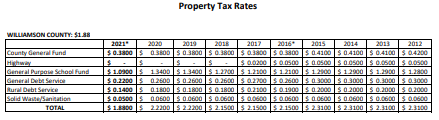

Tax rates for Williamson County and each city or town within Williamson County are set each year by their respective legislative bodies (County Commission and governing bodies) based on the budgets they pass to fund programs and services.

Contrary to popular belief, the Property Assessor does not set the tax rate, does not send out tax bills, and does not collect property taxes.

The County Trustee is responsible for using that tax rate and the tax roll from the Assessor’s office to create and send out tax bills to all county property owners. The Trustee is also responsible for collecting county property taxes.

Click image for larger version

Contact Information

The Williamson County Trustee (http://www.williamsonpropertytax.com) collects property taxes for Williamson County, the Franklin Special School District and the cities of Brentwood, Franklin, Thompson's Station, and Nolensville. City taxes for Fairview and Spring Hill are collected by the cities themselves. All other city taxes are collected by the cities themselves. Contact your city government for tax collection information if you are a resident of Spring Hill or Fairview.